To prepare tax returns, volunteers must obtain at least an IRS’ Volunteer Standards of Conduct (Ethics) Certification and a certification for Basic Preparers. UWGA will be providing in-person and virtual training in November and December to help volunteers pass these certifications. Volunteers can also do self-study to be certified. Learn more about the certification.

If you aren’t sure about your ability to help e-file taxes but would still like to volunteer, don’t worry — we still need your help! There are other positions to be filled at VITA locations that don’t require computer skills or passing the tax preparation course.

Sign up today to volunteer!

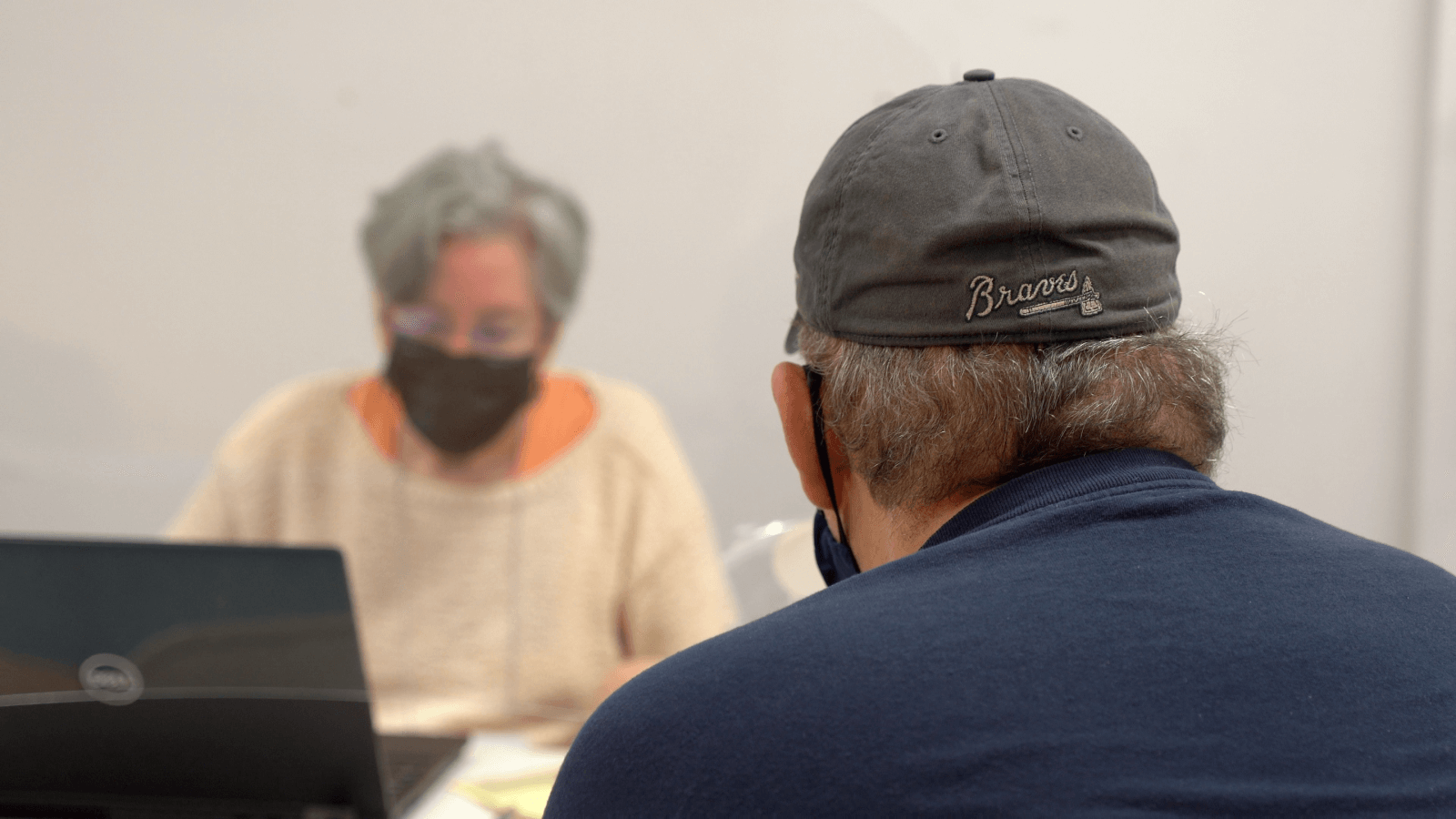

Having conversations with VITA service users is an important part of being a VITA tax preparer.

Having basic computer knowledge is required to help e-file taxes.

Volunteers should be able to work one shift a week during tax season.

404.527.7200

© Copyright 2024 United Way of Greater Atlanta. All Rights Reserved.

Today your donation goes further with a dollar-for-dollar match up to $100,000 from generous friends including KMPG and PwC.