In the past few years, we’ve helped thousands of families across Atlanta move from motels and other temporary stays into long-term housing.

The families we serve are very resilient, often working multiple jobs to make ends meet. However, while the week-to-week grind of housing instability may have been lifted, a single unexpected expense can throw everything off balance. By the time rent is due at the end of the month, those added costs often leave families already falling behind on their finances.

As we help more families secure housing in a state where nearly half its residents struggle to afford the cost of living, we asked the question: how can we bridge the gap for families just getting their feet back under them?

United Way of Greater Atlanta, Community Restoration Project, and Self-Help Credit Union set out to answer this question through an innovative microloan partnership.

The hidden cost of credit

When families have unexpected expenses and no savings to cover them, traditional avenues usually only offer financing to families with credit scores of 580 or higher. The average credit score of families United Way of Greater Atlanta works with is 556, and that small discrepancy can end up costing the family thousands in interest when crises hit. In other words, a quick-fix loan can quickly become a new hardship for families.

“The cost of credit to individuals with bad credit is what kills your budget,” Phil Hunter, founder of Community Restoration Project said. “Because their credit scores were not high enough and they had delinquencies, they couldn’t go to a regular bank or credit union and borrow at market rate because they wouldn’t qualify.”

The other options? Pawning items like a car title, or for some, taking on payday loans that automatically deduct money from their paycheck before they even receive it at predatory interest rates reaching as high as 300%. At rates like that, families may pay hundreds of dollars in fees, and still not be making a dent in the original amount they borrowed.

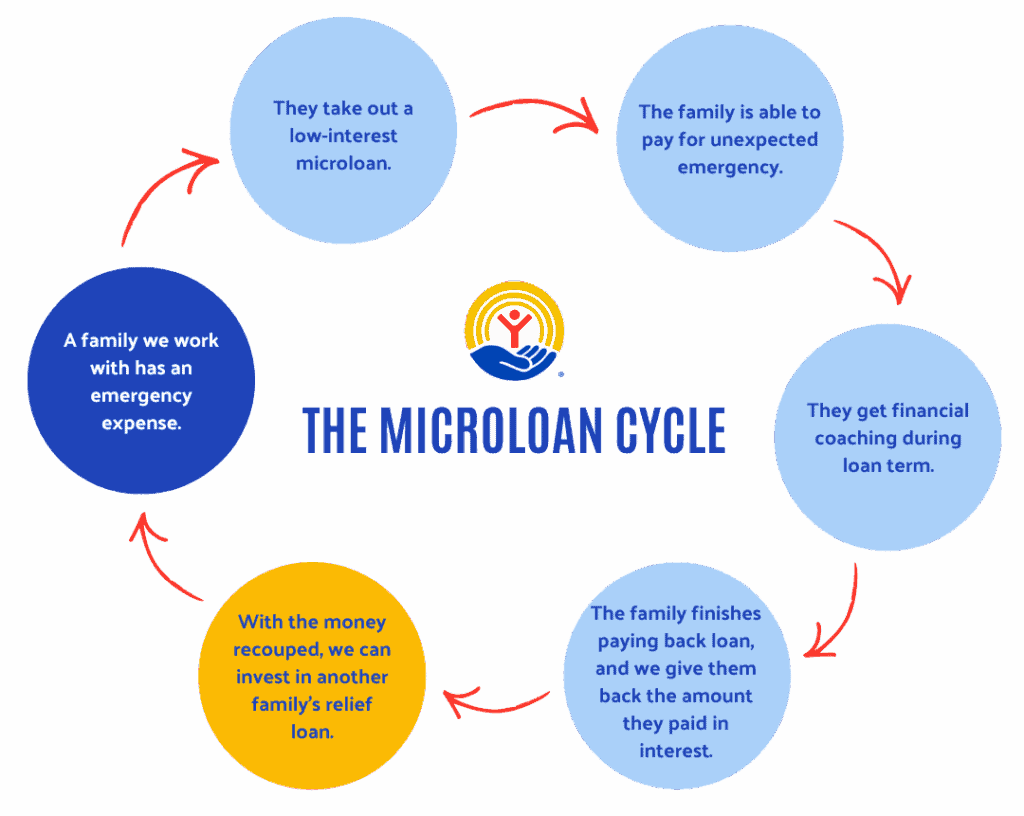

Microloans—a type of small relief loan—offer families a chance to pay off some of their debt or unexpected emergency expenses, while avoiding the cycle of high-interest debt.

>> RELATED: Motel-to-Home: The Moulton Family

Our microloan program offers loans from $500 to $1500 at a 7.25% interest rate underwritten by Self-Help Credit Union, financially backed by us, and given to families identified by Community Restoration Project.

“It’s a win-win for both partners and the residents. They’re able to access the financing they need on great terms, and we’re able to offer lower interest rates,” said Mandy Eidson, Director of Business Development and Community Engagement at Self-Help Credit Union.

During the six to eighteen months of the relief loan term, families meet regularly with Phil for financial coaching. If the microloan is paid back on time, we’ll return the interest back to families, making it essentially a 0% loan, but with all the credit benefits.

Through this innovative relief program, we’ve offered 23 families a microloan so far, and their stories show how this small act can redirect the course of their financial journey.

Crystal’s Fresh Start

Crystal Singleton was on the path to financial success, working a stable job and even owning a home in Florida before she relocated to Atlanta. However, a divorce left a significant dent in her savings—and her credit. Finding housing in the city was next to impossible and she became stuck, staying in Airbnbs.

“You cannot find a place without having pristine credit,” she said. It wasn’t until she was connected to Community Restoration Project that she was able to find a stable place to call home.

She found a new job as a brand ambassador in Atlanta, but then her employer unexpectedly delayed her start date, delaying her first paycheck until after rent was due. We offered her a microloan, which allowed her to pay her rent in her new apartment on time without taking out a high-interest payday loan, while rebuilding both her credit and her future.

And she knows for a fact, with the help of our relief loan program and the financial foundation it has set, she’ll be able to get back to being a homeowner again one day.

“I just have to be patient. I learned from the financial wellness program not to be so hard on myself. I thought, ‘I’m going to get to Atlanta, and in two years, I’m going to have me a house,’” she said with a laugh. “Now it’s more ‘slow down, maybe like five years to seven.’ But I am still working towards that goal. And I know for a fact I will accomplish it because I’ve done it in the past. I know what I need to do. I just have to let time lead me there.

Shawnniece’s generational change

Like Crystal, Shawnniece Yarborough found Community Restoration Project through our Motel-to-Home partnership. She’s worked hard and already moved into a larger space since leaving the motel and her first apartment, and now enjoys having a place with a bedroom for each of her kids. But a debt from her time in the motel as well as some unexpected dental bills still followed her, and she was struggling to pay it off and stay up to date on her bills.

For Shawnniece, our relief loan helped, but the life-changing part was the financial education that came with it.

“I learned it’s the buy-now-pay-later apps—they are helpful, but they become bills. And I once I saw that using [Phil’s] budget template, this is the money that I can be saving. It’s not a bill that I have to have, like my light bill or my rent. This is not a necessity bill. This is basically a debt that I’m trying to get myself out of,” said Shawnniece.

Today, she’s been following the budget template, has paid her car off, and is able to put even more towards the principal of the relief loan each month. She’ll pay it off early, in December, and get a credit boost along the way.

“Right now, I’m working towards financial freedom. People don’t understand that good credit can take you far, just like cash can.”

“I want to be able to show my kids,” said Shawnniece. “I have a 15-year-old son and a 6-year-old daughter. I’m trying to be able to have it to where, by the time next year comes, I can start putting them as authorized users on a credit card, so that they can start getting good credit before they are even using their credit. I want to be able to provide and help them, because I wasn’t taught that.”

The access to financial coaching and tools that our relief loan program provides will not just solve a one-time crisis, but can also create generational outcomes for financial stability.

“One of the greatest ways to build economic mobility is to have access to people that are outside of your economic bracket,” said Rorie Scurlock, Associate Vice President of Economic Stability at United Way. “It’s a two-way street. There are systemic issues that need to be addressed, but we also need to educate people on the system that they’re living in, imperfect and all.”

>>RELATED: “It saved my life”: Financial Achievement Club interrupts cycle of poverty

For families like Shawnniece’s, who will pay off the loan in the coming months, the increased credit and established history with Self-Help Credit Union will make them eligible for additional savings throughout the month.

One loan program participant who fully paid off their loan saw a 30-point increase on their credit score. This increase saves participants money on traditional loan repayment, and also can help save money with rent deposits, utility companies, and car financing.

For example, Phil hopes that for some of his clients who have 25-35 percent interest rates on their car loan, after paying off the microloan they’ll be eligible to refinance through Self-Help Credit Union at 5-10 percent, saving them hundred dollars a month that could go towards other necessities, or savings towards homeownership like Crystal wants.

Ultimately, the goal of the partnership is to help rebuild trust and access to financial institutions in communities that have historically been left out or even preyed upon.

“It’s not a transactional relationship that we have with our CRP clients, it’s relationship-based community banking,” said Taylor Drakeford, Regional Manager at Self-Help Credit Union. “The goal is to make sure they’re empowered by their credit scores, and empowered by the products and services we offer.”

Expanding access for Greater Atlanta Families

The microloan model is replicable. Since United Way of Greater Atlanta recoups the cost of the loan, we hope to extend this lifeline to more families in need.

“This program is giving families the tools to not just get out of the immediate crisis…but it also helps us recycle the limited resources that we have,” said Rorie. “For a family that can and is willing to pay it back, then that helps us cycle the money two, three, even four times to assist other people who are in crisis.”

So far, twenty-three families have taken a step towards a brighter financial future, and we have willing partners lined up—we just need the support of our community to increase the relief loan program’s capacity.

You can help families like Crystal and Shawnniece build lasting financial stability. Your donation isn’t just a gift—it’s a micro-investment in generational change. Join us in expanding this life-changing program by donating today.